Transferable credit card rewards are especially valuable because of the many ways you can redeem them. You might be familiar with rewards like Chase Ultimate Rewards points and American Express Membership Rewards points. But, another transferable reward currency that can offer significant value to some travelers is Capital One miles.

Capital One miles are appealing for several reasons. First, several Capital One cards earn at least 2 miles per dollar on all purchases. Second, it’s easy to get at least 1 cent per Capital One mile when you redeem. And third, it’s possible to get significantly more than 1 cent per mile if you use Capital One’s transfer partners.

So, here’s everything you need to know about Capital One miles.

What are Capital One miles?

Capital One miles are the rewards you earn with select Capital One cards, including the Capital One Venture Rewards Credit Card and Capital One Spark Miles for Business.

You can redeem these miles in many ways, including by transferring to select airline and hotel loyalty programs, redeeming for travel booked through the Capital One travel portal and redeeming to cover recent travel purchases.

Related: Why the Capital One Venture Rewards credit card still has a spot in our wallets

How to earn Capital One miles

Although Capital One offers many different credit cards, the Capital One cards that earn transferable miles are those in the Venture and Spark Miles families. Here’s a quick look at some of these cards and their current welcome offers:

- Capital One Venture X Rewards Credit Card ($395 annual fee): Earn 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening.

- Capital One Venture Rewards Credit Card ($95 annual fee): Earn 75,000 bonus miles after spending $4,000 on purchases within the first three months of account opening, plus a $250 Capital One Travel credit in the first cardholder year.

- Capital One VentureOne Rewards Credit Card (No annual fee): Earn 20,000 bonus miles once you spend $500 on purchases within the first three months from account opening.

- Capital One Venture X Business ($395 annual fee): Earn 150,000 bonus miles when you spend $30,000 in the first three months.

- Capital One Spark Miles for Business ($0 introductory annual fee for the first year, then $95 after): Earn a one-time bonus of 50,000 miles once you spend $4,500 on purchases within the first three months of account opening.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

The current limited-time welcome offer on the Capital One Venture Rewards Credit Card is worth mentioning. Compared to the standard offer usually available on this card, it offers an additional $250 Capital One Travel credit in the first cardholder year.

You can convert Capital One cash back into miles if you have one of the above cards. So, if you have a Capital One card like the Capital One Savor Cash Rewards Credit Card that earns cash-back rewards, you can convert your cash-back rewards into Capital One miles if you also have a card that earns Capital One miles.

Related: The best time to apply for these popular Capital One credit cards based on offer history

Capital One transfer partners

Here’s a look at the current Capital One transfer partners and the standard transfer ratios:

- Accor Live Limitless: 2:1 transfer ratio

- Aeromexico Rewards: 1:1 transfer ratio

- Air Canada Aeroplan: 1:1 transfer ratio

- Air France-KLM Flying Blue: 1:1 transfer ratio

- Avianca LifeMiles: 1:1 transfer ratio

- British Airways Executive Club: 1:1 transfer ratio

- Cathay Asia Miles: 1:1 transfer ratio

- Choice Privileges: 1:1 transfer ratio

- Emirates Skywards: 1:1 transfer ratio

- Etihad Airways Guest: 1:1 transfer ratio

- EVA Airways Infinity MileageLands: 4:3 transfer ratio

- Finnair Plus: 1:1 transfer ratio

- JetBlue TrueBlue: 5:3 transfer ratio

- Qantas Frequent Flyer: 1:1 transfer ratio

- Singapore Airlines KrisFlyer: 1:1 transfer ratio

- TAP Air Portugal Miles&Go: 1:1 transfer ratio

- Turkish Airlines Miles&Smiles: 1:1 transfer ratio

- Virgin Red: 1:1 transfer ratio

- Wyndham Rewards: 1:1 transfer ratio

Transfer bonuses may occasionally let you transfer Capital One miles to one or more partner programs at an elevated rate. But remember that transfers are one-way: Transferring rewards back to Capital One miles is almost always impossible once you’ve transferred them to a loyalty program.

Related: Why transferable points and miles are worth more than other rewards

How to redeem Capital One miles

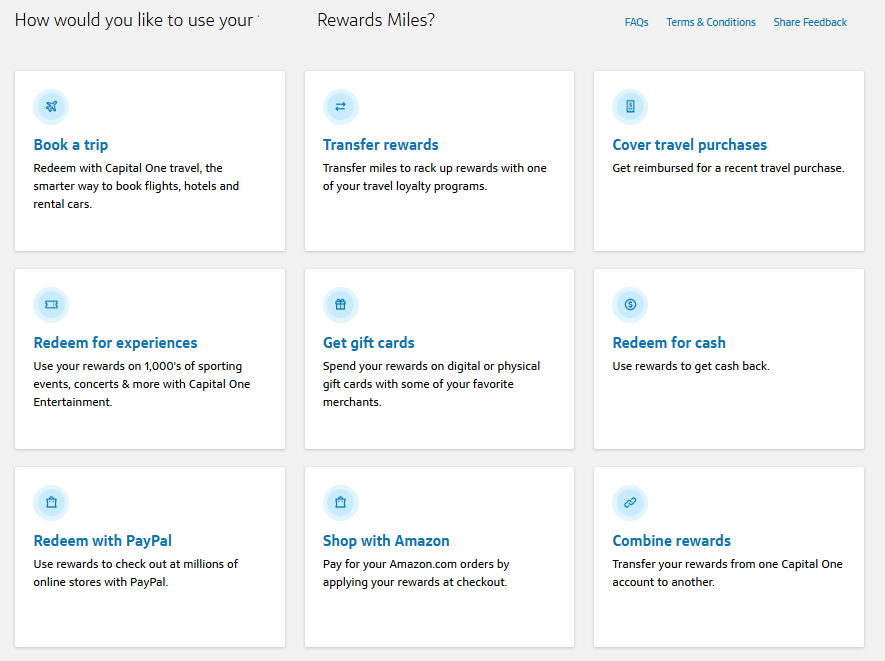

You’ll see multiple options for redeeming Capital One miles in your online account.

You’ll typically get the best value when you transfer your miles to airline and hotel partners. But, you can also get decent value when booking through the Capital One travel portal or redeeming miles to offset recent travel purchases. Here are your options and the redemption value each should provide.

Redeem with airline and hotel partners

As mentioned above, you’ll typically get the best value from your miles when you transfer them to airline and hotel partners by clicking “Transfer rewards.” In the previous section, I listed the Capital One transfer partners and the ratios at which you can transfer Capital One miles to each partner.

Based on TPG’s February 2025 valuations, you can expect to get 1.85 cents per Capital One mile when you transfer to airline and hotel partners and then redeem through those programs. However, the exact value you get will depend on which transfer partners you use and the types of awards you book with these partners. See our story on maximizing Capital One miles for some recommendations.

Related: How to transfer Capital One miles to airline and hotel partners

Book through the Capital One travel portal

You can also redeem miles at a rate of 1 cent per mile when booking flights, hotels and rental cars through the Capital One travel portal.

However, if you book paid travel through the Capital One travel portal with your Capital One card that earns transferable miles, you can earn 5 or 10 miles per dollar depending on your card and the type of travel you purchase. As such, I recommend booking paid rates instead of redeeming miles when you book travel through the Capital One travel portal.

Even if you want to redeem Capital One miles for your flight, hotel or car rental booking, you’ll usually be better off using miles to cover recent travel purchases instead of redeeming when booking through the travel portal.

Related: Should you transfer Capital One miles to partners or redeem directly for travel?

Cover travel purchases

You can redeem Capital One miles to cover recent travel purchases made with your card. Capital One says eligible travel purchases usually include those you make from “airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents and time shares.” However, whether a specific purchase is eligible depends on the merchant category code attached to the purchase.

You’ll see any eligible purchases — which are travel purchases posted to your account in the last 90 days — listed in your online account when you click “Cover travel purchases.” You can use miles to cover the entire purchase or just part of it. Either way, your miles are worth 1 cent each when you redeem them to cover recent travel purchases.

Related: Capital One Venture Rewards vs. Capital One Venture X: Worth the extra $300 in annual fees?

Other ways to redeem Capital One miles

As you might have noticed in the screenshot above, cardholders have several other options for redeeming Capital One miles. Most of these other redemption options offer lower redemption values, so we don’t generally recommend using them. But here’s an overview of your other redemption options:

- Redeem for experiences: You can redeem miles for sports, music, comedy and theater tickets through Capital One Entertainment, usually at a redemption rate of 0.8 cents per mile.

- Get gift cards: You can redeem miles for gift cards, usually at a redemption rate of 0.8 cents per mile.

- Redeem for cash: You can request a statement credit or a check to your address at a redemption rate of 0.5 cents per mile.

- Redeem with PayPal: You can apply miles when checking out with PayPal at a redemption rate of 0.8 cents per mile.

- Shop with Amazon: You can apply miles at checkout for your Amazon orders at a redemption rate of 0.8 cents per mile.

Earlier in the article, we discussed several ways to redeem Capital One miles for at least 1 cent each. So, there will rarely be a reason to redeem Capital One miles for anything less than 1 cent each.

Bottom line

When traveling overseas, I often use the Capital One Venture X Rewards Credit Card as my everyday spending card. It doesn’t charge foreign transaction fees, and I know I’ll earn at least 2 miles per dollar on all purchases. I rarely have issues using it. But, I also generally find it useful to have access to Capital One miles when booking award flights. So, I’m always happy to earn more Capital One miles on my everyday purchases.

Now that you know how to earn and redeem Capital One miles, I expect you may also understand their value — especially if you transfer your miles to airline or hotel partners.