Following a delayed pandemic recovery for the airline segment across Denmark, Norway and Sweden, airline seat capacity increased dramatically in 2023.

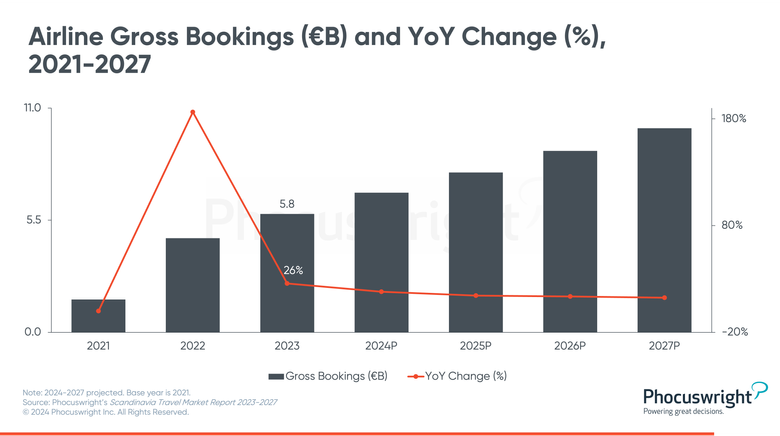

This expanded capacity helped to fuel 26% growth in gross bookings according to Phocuswright’s research report Scandinavia Travel Market Report 2023-2027, far more than any other travel segment.

The outlook through 2027 is positive, with double-digit growth expected each year as Scandinavian travelers indulge their wanderlust.

However, while airline gross bookings are projected to surpass pre-COVID levels by 2026, many factors threaten a sustained recovery.

Market leader SAS has struggled for more than a decade with high costs and weak profitability, leading the company to file for bankruptcy protection in July 2022 in the United States as it sought new owners following the pandemic.

After finding new investors in a consortium of Castlelake, Air France-KLM, Lind Invest and the Danish state, SAS expects to emerge from an amended Chapter 11 plan of reorganization by the end of the first half of the 2024 fiscal year.

With Air France-KLM now holding a 20% stake in the restructured SAS, the deal shows how European legacy carriers are consolidating around just three players: Air France-KLM, Lufthansa and IAG.

Although low-cost carriers (LCCs) such as Ryanair, Wizz Air and Norwegian Air continue to challenge traditional airlines, SAS’s CEO downplays the fierce competition from LCCs. If LCCs continue to gain market share, industry revenue will almost certainly be lower than projected, assuming the same volume (in terms of number of flights).

Phocuswright Open Access